2022 was a roller coaster of a year. Wages climbed, inflation skyrocketed, and states began passing pay transparency laws. It’s been a lot to deal with for compensation professionals.

Going into 2023, many organizations are worried about the economy as talk of a coming recession has dominated the news and layoffs have been all over social media feeds, especially LinkedIn. But the possibility of a recession has caveats, especially where the labor market is concerned — and these have implications for your talent strategy and compensation strategy.

Inflation (recession?) and the state of the economy going into 2023

Around the world, central banks have been raising interest rates in sharp, periodic bursts to tame inflation. As you can see in the chart below, interest rates have been comparatively low in recent decades and almost nonexistent in the years following the Great Recession of 2007–2009 and the COVID-19 recession of 2020. But they have gone up sharply in 2022.

You can also see from the chart that recessions tend to follow interest rate hikes — not every time, but most of the time. Raising interest rates makes investing more expensive, which lowers demand for capital expenditures, which has a ripple effect on expansion, the job market, consumer spending, and GDP growth. The interest rate hikes in 2022 were the most aggressive they have been since 1994.

With such a shock to the market, it is uncertain whether a recession can be avoided. However, it is important to note that the stated objective of the Federal Reserve is to “achieve maximum employment and inflation at the rate of 2 percent over the longer run” — in other words, lower inflation without triggering a recession.

Of course, that intention doesn’t account for pessimism. It is difficult to predict how corporations, investors, and consumers will react to speculation about the economy. Fear that a recession is coming could trigger or deepen one that would otherwise have been more of a correction. And there are many variables to consider from supply chain disruption to the war in Europe to dissolving trust in cryptocurrencies.

Job openings and unemployment

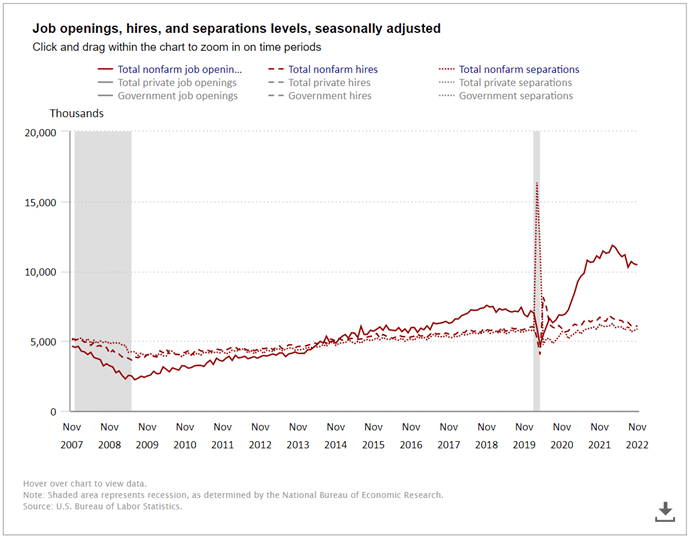

However, despite recent layoffs, the labor market is strong. The most recent report from the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics (BLS), which came out today (January 6, 2023), puts unemployment at 3.5 percent for December 2022. This is a decrease from 3.7 percent in November and is well below the average unemployment rate of 5.74 percent from 1948 to 2022.

The most recent JOLTS report encapsulates at least some of the layoffs that were announced in Q4. Although more layoff announcements are likely to come in January and potentially throughout 2023, the current state of the labor market is unusually sound. So far, layoffs have not impacted unemployment at all. This could signal that fears of a recession are more emotionally driven than data driven, with organizations taking the opportunity to layoff poor performers and improve metrics more than anything else.

What does that mean for competition for talent in 2023? Well, you can see in the chart above that job openings remain well above pre-pandemic levels. For the last two years, the talent war has heated to boiling due to the number of jobs available. Going into 2023, the job market still looks to remain strong — at least in the U.S. Although job openings have dipped in the second half of the year and will likely continue to fall in 2023 as organizations enact hiring freezes in response to a possible recession, there are still more job openings than typical, which means people who were laid off may not be unemployed for long.

In fact, data on unemployed persons per job opening suggest that layoffs have had little to no impact on the labor market. As you can see from the chart below, people really struggled to find work after the Great Recession. The COVID-19 recession saw higher levels of unemployment as shown in the previous chart, but the ratio was lower compared to previous recessions. It is even lower now.

Employers may want to consider this. Mass layoffs may be an overreaction given this scenario, especially if you are still hiring. Many organizations regret the major layoffs that took place in 2020, during a time of similar economic uncertainty. The job market was strong then too, but the same fears of a significant and protracted recession due to rising interest rates and news of a pandemic spurred organizations to make deep cuts.

However, the COVID-19 recession only lasted two months. Some industries did lose demand for services during the pandemic and had to furlough or lay off staff, largely in leisure and hospitality, but others saw a surge in business, especially technology companies. A surge in demand created a red-hot job market that pumped up wages. Global supply chain issues and the war in Europe increased inflation, which then drove up wages even more.

Data-driven talent decisions

The takeaway from this cautionary tale for employers is to not repeat these mistakes. Layoffs may be necessary for businesses facing financial hardship, and some strategic cuts to right-size the workforce may also be appropriate. But such decisions need to be data driven, not arrived at from a feeling of fear or by mimicking other organizations.

The need for conservatism will also vary by industry. For example, job openings in healthcare and professional services are still going strong, whereas job openings in retail and the federal government have plummeted to pre-pandemic levels. This is important to note when it comes to which industries might see layoffs in 2023, as well as how compensation strategies may need to change for industries where talent markets are more competitive.

The impact of an economic slowdown on people strategy and compensation management

Recessions are typically met with fear in the general populace because they mean high unemployment for an undetermined timeframe, with many people struggling to make ends meet. But a mild economic slowdown may be a relief for HR — and even workers may see benefits.

Employees have gained some advantages in the last two years due to the increased demand for labor, which has resulted in more bargaining power. But the recruiting and job seeking experience hasn’t exactly been pleasant. Both job seekers and recruiters have been frustrated by overly complicated application and interview processes, ghosting behaviors, and muddled compensation and rewards policies resulting in disengagement or turnover. A slowdown would give HR a chance to dig deep into strategy and focus more on the employee experience rather than just trying to keep up with a wild job market.

People strategy in general will be important in the years ahead, and compensation strategy will be an especially critical component. Even if unemployment surges, compensation still needs to be competitive and fair to retain your current employees. And if you are concerned about productivity and performance in a smaller workforce, you need to have a compensation program that rewards extra effort.

Trends like “quiet quitting” and “act your wage” became popular on TikTok in the years following the pandemic and have now become household terms. These trends are frequently misunderstood but boil down to employees prioritizing their mental and physical wellbeing and not going “above and beyond” for a job unless there are tangible rewards.

To prepare for the future, organizations need to think strategically about how pay is determined, how employees move up in their pay ranges, how employees are paid compared to others, how performance is rewarded, and how pay policies are communicated to both current employees and job seekers.

Here are just a few of the challenges that compensation managers need to be thinking proactively about in the year ahead:

Pay compression

Pay compression can happen when salary data is outdated or when newer hires are offered pay that is too close to that of more tenured employees with more experience in the same position. Pay compression has been an escalating issue the last few years because the talent market was overheated with organizations having compensation strategies that were poorly communicated to recruiters and hiring managers.

Pay compression is also common following a recession. Sometimes, organizations use economic downturns to justify lowballing salary offers to new hires. However, once the market turns around, salary offers start to increase. People hired at reduced wages during the recession don’t end up making the same pay through annual increases, and this can cause them to become disengaged or seek a new job opportunity.

To avoid pay compression, organizations need to approach compensation strategically and for the long term, with the objectives being employee engagement, satisfaction, and loyalty. This means engaging in regular pay analysis to spot pay compression problems and having processes to make proactive market adjustments for current employees who are flight risks, especially high performers.

After all, nothing drives away a good employee faster than learning they are getting paid less than an employee with fewer years of experience or a worse performance record.

Learn more about how to manage pay compression with agile compensation.

Pay equity

Equal pay for equal work is the law. While pay equity is often talked about in terms of the gender pay gap, racial pay gap, or other class status where pay is legally required to be equal for equal or similar work, it really applies to all workers who have similar job functions or responsibilities. Pay equity reporting has been on the rise to ensure that the spirit of the law is being inspected and fulfilled. If you have a handle on pay compression, you are probably also well prepared to ensure pay equity across the organization.

Pay equity requires pay analysis and monitoring across multiple dimensions. Rather than an occasional project that is conducted in coordination with a legal team, pay equity is evolving to a standard compensation best practice that requires review through the year — but especially during pay raises and promotions.

Learn more about pay equity solutions with Payscale.

Pay transparency

The crème de la crème of compensation management is pay transparency. Although transparency in communications about pay exists on a spectrum, advertising pay ranges publicly in job ads is rapidly on the rise.

By the end of 2022, 11 states had either passed pay transparency legislation or were considering it, and the trend looks to catch on in 2023. But pay transparency is much more than a legislative requirement. It has been shown to close the gender pay gap and the vast majority of job candidates say they want transparency around pay. A survey by ResumeBuilder found that roughly 1 in 20 workers will quit if they find out they are making less than their coworkers and 63 percent will demand a raise for equal pay.

Organizations that haven’t addressed pay equity and pay compression are unlikely to want to make their pay ranges transparent. This hesitancy is understandable. Negative perceptions about pay can lead to issues with attracting and retaining talent. To solve for compression, equity, and transparency, organizations need to get serious about a compensation strategy. They also need to invest in pay analysis and compensation management best practices.

Learn more about pay transparency legislation.

Remote work

Remote work is also continuing to shake up the workforce. Despite the desire of many employers to bring all workers back to offices or at least implement hybrid office environments, employees prefer remote working environments or at least workplace flexibility. Organizations that embrace a remote-first approach — or even just those interested in hiring some remote workers — will have an advantage in attracting and retaining talent. However, adopting remote work practices requires that organizations determine how compensation flexes across geolocations in a manner that is consistent, equitable, and fair, and many are still working this out as well as learning how to be transparent about it.

Learn more about location-based pay strategies.

Conclusion

Regardless of the state of the economy, there are many considerations impacting compensation professionals in 2023 that should make compensation strategy, salary data, and pay analysis essential investments.

Which issues affect your organization the most will depend on your current level of maturity when it comes to compensation best practices as well as the size of your organization, industry, location, and the financial health of your business.

Although the state of the economy is worrying, especially when news coverage turns pessimistic, there is reason to be hopeful. Although a deep recession would be grim, a mild economic slowdown may provide the perfect opportunity to get aligned on your approach to people and compensation strategy and fix problems that arose during the last few years.

Remember, recessions are followed by economic expansions, and that’s really what you need to plan for.