Payscale recently released our 2023 Compensation Best Practices Report (CBPR) and we couldn’t be more excited to share the findings. The report is 93 pages with over 100 charts providing in-depth analysis on the state of compensation management in 2023. The data comes from Payscale’s annual compensation best practices survey, which is fielded from October to the end of December to compensation professionals, HR leaders, business owners and others responsible for managing compensation for employees.

The full report is broken into chapters that include:

- Spotlight on the labor economy

- Strategy and preparedness

- Base pay increases in 2022 and planned for 2023

- Variable pay and benefits

- Job management and pay structures

- Salary data and market pricing

- Skills-based workforces

- Remote work and geographic pay strategy

- Pay equity, diversity, and ESG

- Pay transparency and communications

- HR and comp management predictions

Every part of this year’s report is fascinating, but to get you excited about digging into it, we have included some of the top findings here for you to digest. Here are some of the big themes for 2023:

Pay increases will not keep pace with inflation

2022 was a year of record inflation, with rates reaching a 40-year high in the U.S and double or even triple digits elsewhere in the world. Employees know that rising inflation erodes the value of their wages, which results in demands for wage increases.

Salaries tend to be determined according to cost of labor rather than cost of living, but organizations still must adjust pay to retain workers when rising inflation impacts competition for labor — which is especially common for lower-wage workers.

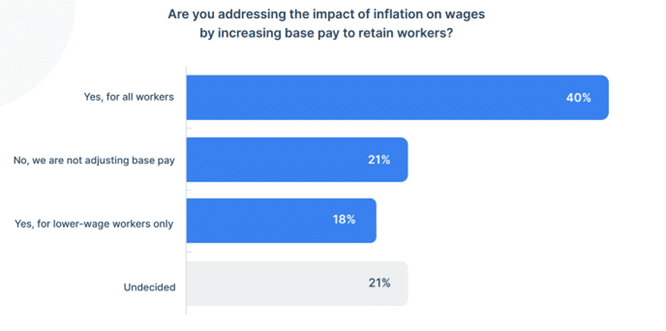

According to our Compensation Best Practices Report, most organizations (58 percent) are addressing the impact of inflation on wages for at least some of their workforce, with 40 percent focusing on the whole workforce, 18 percent focusing on lower-wage workers only, and another 21 percent undecided.

When it comes to giving pay increases, 80 percent of organizations say they will be giving some kind of base pay increase to employees in 2023, but a whopping 15 percent say they are unsure. Although pay increases look to remain higher than usual compared to previous years, pay increases do not look to be as high as inflation. More than a majority of organizations (56 percent) say that pay increases will be over 3 percent. But between 4-5 percent is more likely to be the average.

Organizations that are hesitant to increase bay pay too highly may try to mitigate the problem by offering bonuses or stipends to workers on a temporary basis until inflation stabilizes. According to our survey, 78 percent of organizations offer some kind of bonus to employees and 37 percent of organizations are offering bonuses to address inflation. Another 34 percent are offering stipends to offset increased expenses.

Interested in what pay increases will look like in 2024? Take Payscale’s Salary Budget Survey, which runs in the spring and is released in the summer to inform compensation budget planning for the following year.

We are not in a recession… at least not yet

At the beginning of 2023, alarm bells were ringing, indicating that a recession was just on the horizon. Central banks have been raising interest rates to cool inflation since last year, and it’s working, but the impact on the economy has been uncertain. A big indicator for whether or not the economy is in a recession is the health of the labor market.

According to Payscale’s Compensation Best Practices Report, 60 percent of organizations feel that labor challenges were greater in 2022 than in previous years. However, voluntary turnover dropped from 36 percent to 25 percent. The Great Resignation has cooled, but employers are still in a tight labor market — just not a white hot one.

Because the labor market has remained strong overall, a recession is looking less likely now than it did just a few weeks or months ago. Although there has been rampant news of layoffs, the unemployment rate has been dropping and quits rates remain elevated according to data from the US Bureau of Labor Statistics. This is good news for job seekers and may — in conjunction with increased consumer spending — prevent a deep recession or avoid one altogether.

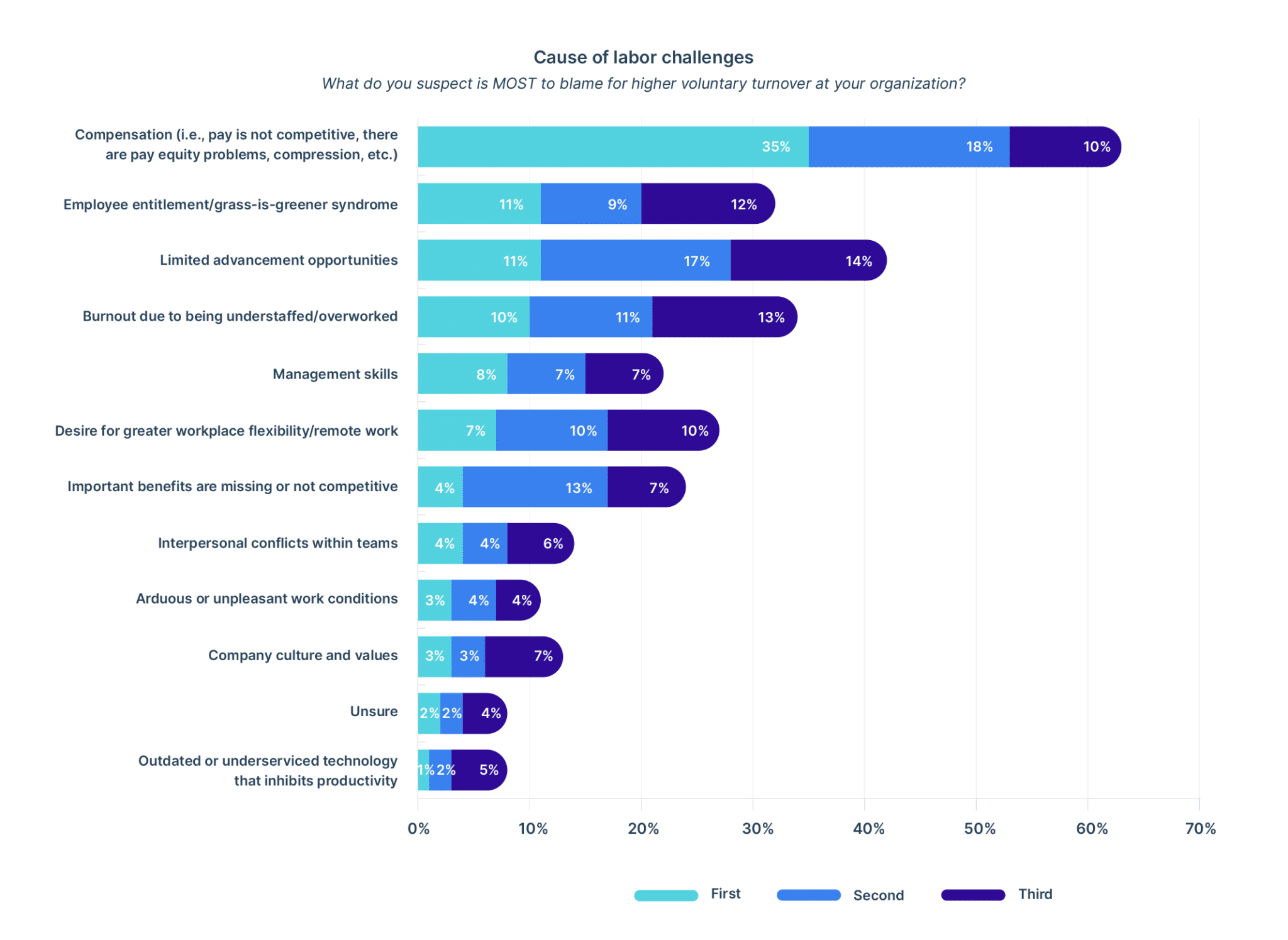

However, the situation is perplexing for employers. Despite many employers giving higher pay increases than they have in decades, real wages are still in decline and wage growth still feels out of control for many industries — healthcare in particular. According to Payscale’s Compensation Best Practices Report, compensation is viewed as the leading cause of turnover in the present market. Given that this labor market is tricky, HR leaders and compensation professionals must be extra vigilant that pay practices are well-structured, consistent, and fair.

Pay transparency is changing the game

One of the bright spots of 2022 was the emergence of pay transparency legislation, which has picked up steam in early 2023 and looks to continue to expand — not just in the United States, but across the globe.

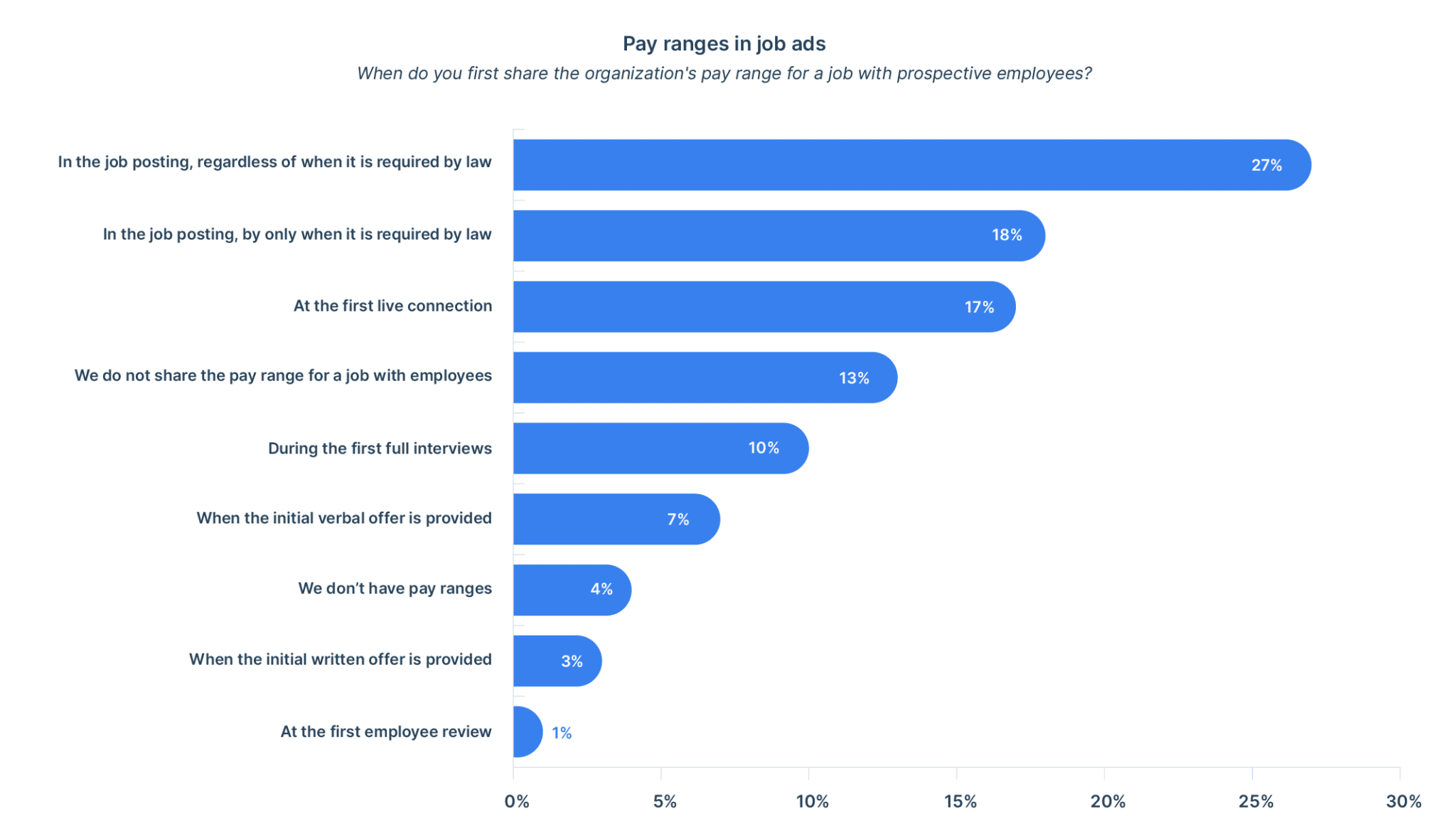

Pay transparency legislation will require organizations to publish pay ranges to job advertisements — at minimum. These laws have been met with a mix of reactions from organizations, including trying to skirt the intent of the law by publishing very broad pay ranges that are functionally useless to job seekers. However, most organizations are publishing pay ranges in good faith.

According to Payscale’s Compensation Best Practices Report, 45 percent of organizations are now publishing pay ranges regardless of whether or not it is required by law. Although this is still a minority of organizations, it is double from what it was last year and is likely to increase substantially as pay transparency legislation expands to more states and metro city areas.

The intent of pay transparency legislation is to close the gender pay gap, as well as other pay gaps applicable to protected classes. Research from Payscale has shown that organizations with high pay transparency do close the gender pay gap — at least when data are controlled. Pay transparency legislation closes the gender pay gap because it forces organizations to examine and remediate inequity in their pay practices. In addition, advertising pay ranges can close the pay gap by showing job candidates — especially women and minorities — what various jobs are worth.

Employees are resisting return to office mandates

Remote work is still a hot workforce topic. Employees overwhelmingly want flexibility when it comes to the workplace. However, some organizations are loath to allow employees to continue working from home in a post-pandemic world.

Some of the hesitation is due to investment in corporate offices and concern about work-from-home eroding culture, but the biggest reason seems to be fear that employees aren’t working when they aren’t being watched.

Declines in productivity supports this claim. According to research by EY-Parthenon, Ernst and Young’s global strategy consulting arm, productivity in the United States has declined for five straight quarters. However, it isn’t confirmed that these declines are due to remote work. They may also be fueled by the failure of compensation to keep up with inflation or reward employees for higher productivity, which is the leading instigator for quiet quitting and a disengaged workforce, which impacts productivity regardless of where employees do their work.

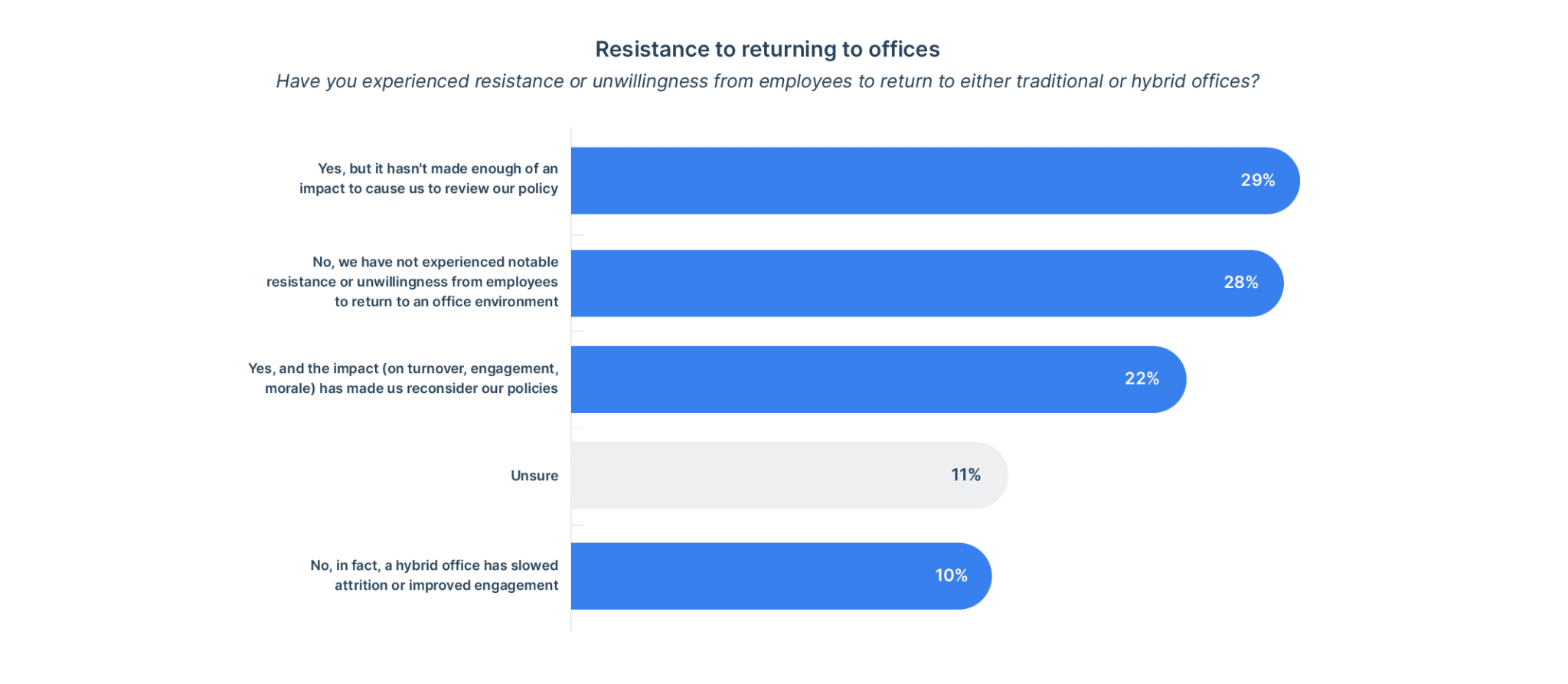

When it comes to calling remote employees back to office environments, 51 percent of organizations say they are experiencing resistance, according to Payscale’s Compensation Best Practices Report, but only 22 percent feel that the impact is great enough to consider a policy change.

Regardless, 89 percent of organizations say that they are either on-site, hybrid, or split by job type going into 2023. This means that remote work is — so far — unlikely to vastly change pay practices as most organizations will continue to hire within a commutable distance to offices.

Interested in more insights on remote work? Payscale will be releasing a Remote Work Report in September. Sign up to receive the report and let us know your burning questions.

2023 is the year of retention – and compensation is key

Overall, 2023 is shaping up to be the year of retention. Compensation is central to equation, not just to retain employees, but also to engage them. Given the added pressured of inflation and pay transparency legislation, there has never been a more urgent need to revisit your compensation strategy and invest in compensation best practices, salary data, and compensation management software.

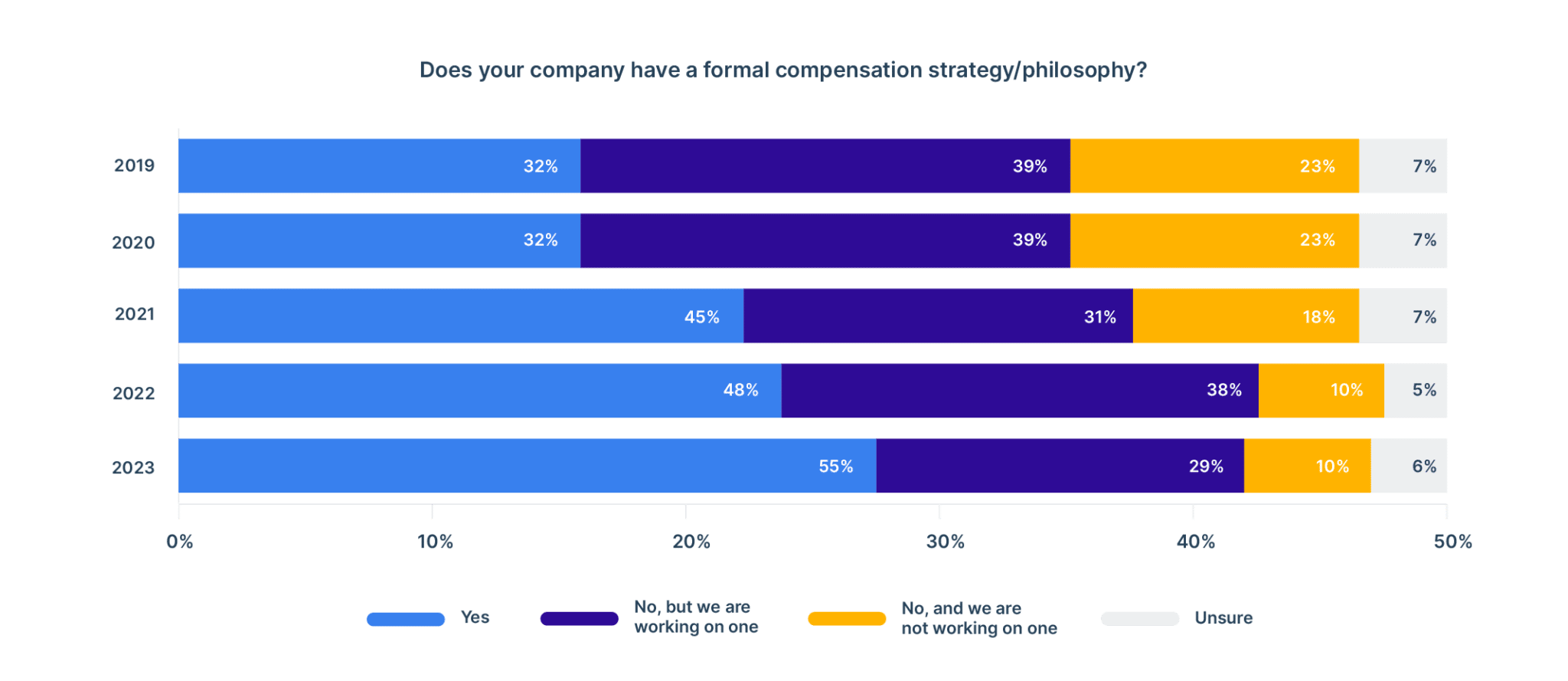

According to Payscale’s Compensation Best Practices Report, 55 percent of organizations report having a formal compensation strategy, which is the highest it has ever been. In addition, 61 percent of organizations report having a dedicated compensation person or team to build and manage their pay practices.

That’s a majority, but it should be even higher.

And although organizations are working diligently to overhaul outdated pay structures and modernize for the future of work, all that effort is wasted without attention being paid to manager training and pay communications.

One of the biggest frustrations for HR leaders is when executives and managers think they are doing the business a favor by underpaying employees. This isn’t a good talent strategy and is never worth it. Unfortunately, many employees feel that this is how most businesses intentionally operate. According to Payscale’s Fair Pay Impact Report, employees tend to believe they are underpaid even when they are paid fairly, or even overpaid for their job compared to the market.

The best way to circumvent these challenges is to overcommunicate about pay practices to ensure that both managers and employees understand how the organization competes for talent, how fair pay is determined, and why it is important. Unfortunately, according to Payscale’s Compensation Best Practices Report, only 49 percent of organizations provide managers with training on pay communications. Although this is up from 36 percent in 2022, it still falls short of a majority. Even for large organizations with over 50,000 employees, still only 65 percent are certain they provide manager training on compensation practices. Unsurprisingly, only 57 percent of organizations provide employees with a total rewards statement, 15 percent of which actually only encompasses total cash compensation.

The takeaway here is that organizations can do better when it comes to pay communications. Of course, this begins with compensation strategy.

Payscale offers a variety of products and services to assist organizations with modernizing and maturing their pay practices. From salary data for market pricing, to compensation management software, to professional services and solutions for challenges like pay equity, pay transparency, and pay communications, Payscale has everything you need to become a leader in compensation management today.

Download the Compensation Best Practices Report.