Payscale’s newly released Fair Pay Impact Report shows that people believe they are underpaid even when they are paid at or above market. In addition, people who believe they are underpaid are 50 percent more likely to seek new opportunities. Fortunately, pay transparency is shown to reduce job seeking behavior.

This research couldn’t come at a better time. The labor market is undergoing a revolution. Wages are rising, there are more job openings than applications, and turnover is increasing. Post COVID-19, employers are scrambling to identify strategies for talent acquisition and retention that actually work.

Increasing base pay is an important part of retention, especially for underpaid workers and for low wage workers who have suffered from wage stagnation for over a decade, but there is a limit to what organizations can offer when it comes to wages without creating pay compression and inequity across the organization.

Fortunately, pay communications are something every organization can do to increase retention. The problem is that most organizations don’t engage in pay communications, which means that a lot of their effort to compensate employees fairly, competitively, and equitably goes unnoticed and doesn’t have the impact on morale and retention that it could.

This research is not new.

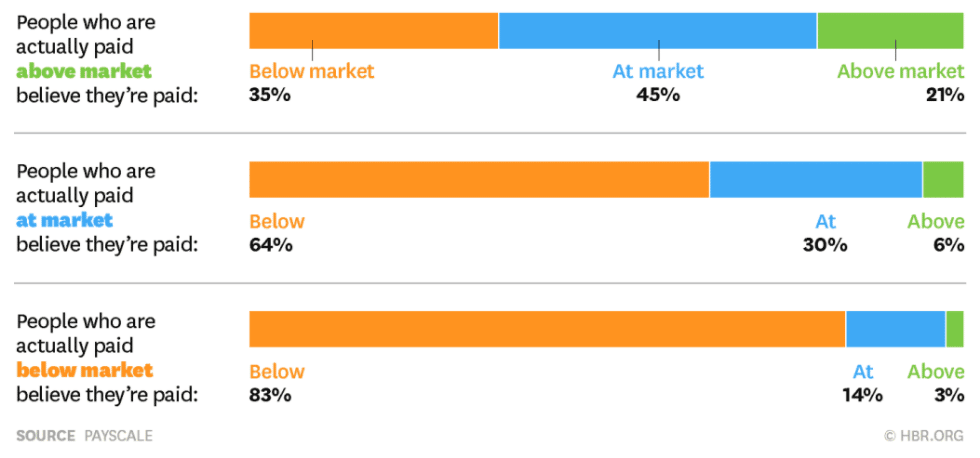

In 2015, Payscale did a study of 71,000 employees that showed people tend to believe that they are underpaid even when they are paid at or above market. In addition, pay communications was shown to be one of the top predictors of employee sentiment and job satisfaction. In fact, Payscale’s research showed that being transparent and honest about pay was a higher indicator for employee engagement than career advancement opportunities, recognition, and enthusiasm for the company.

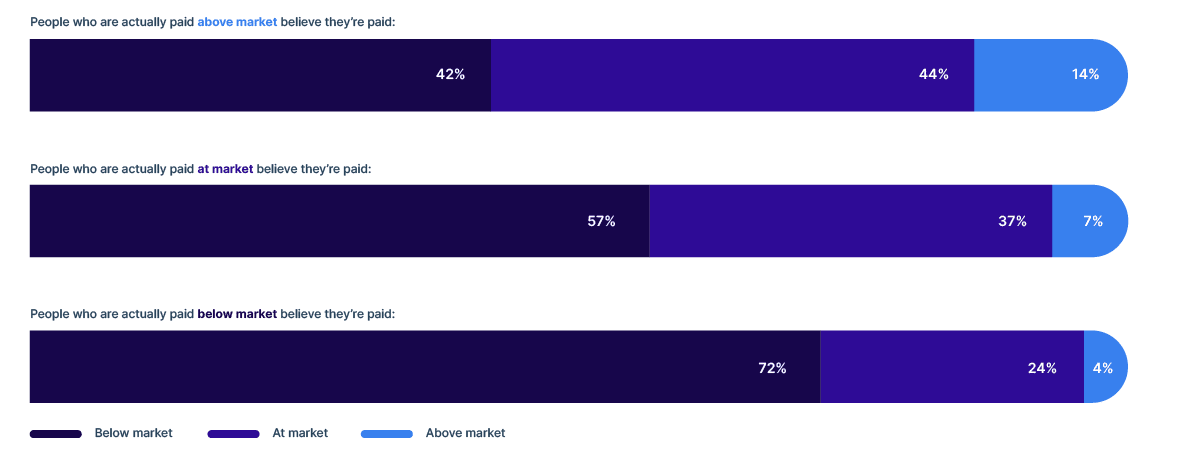

In 2021, Payscale updated this research and found that — if anything — perception of fair pay seems to have gotten worse. In 2015, 35 percent of people who were paid above the market rate believed they were paid below market. In 2021, that number has climbed to 42 percent. This seven percent shift is equivalent to the difference in people who believed they were paid at market in 2015 (66 percent) compared to 2021 (57 percent), essentially meaning that the same percentage of people who falsely believed they were underpaid in 2015 when they were actually paid at market still believe they are underpaid when actually paid above market.

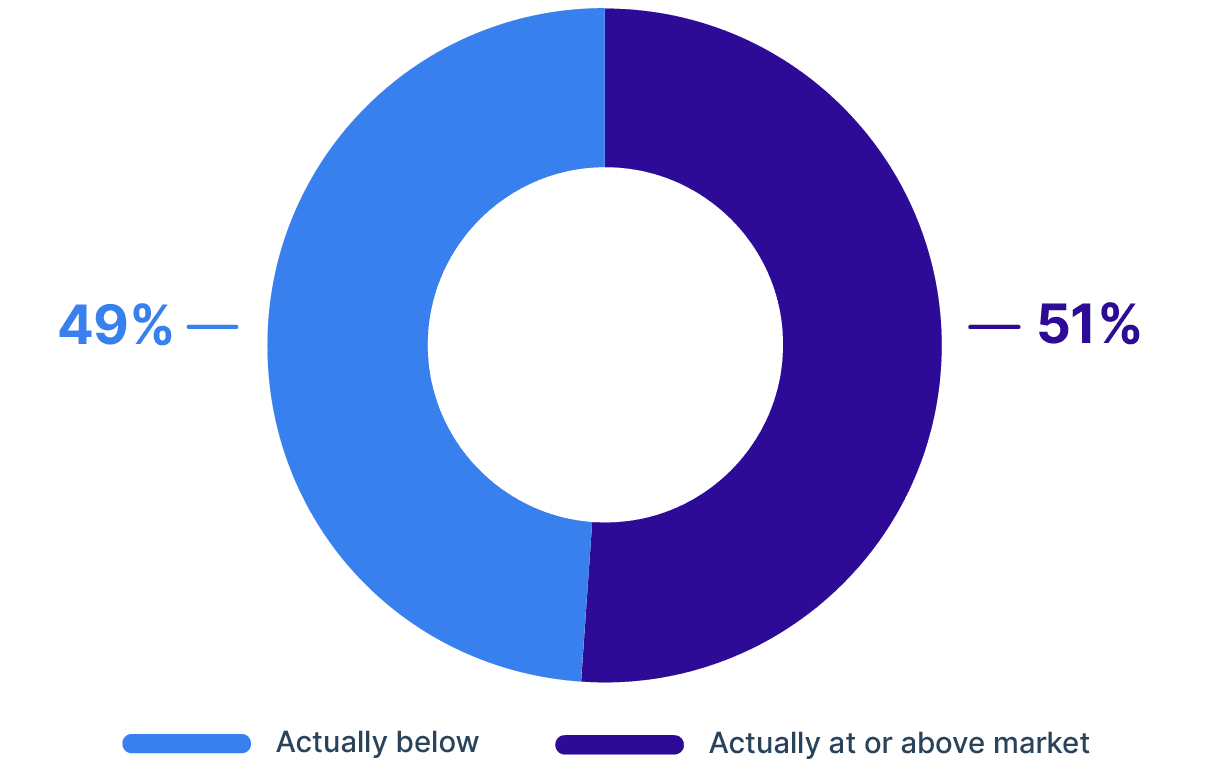

What this indicates is that your employees have no idea what is fair and competitive pay and likely harbor false beliefs about what they could earn on the open market in a similar position. Holistically, a majority of workers (51 percent) paid at or above market believe they are paid below market.

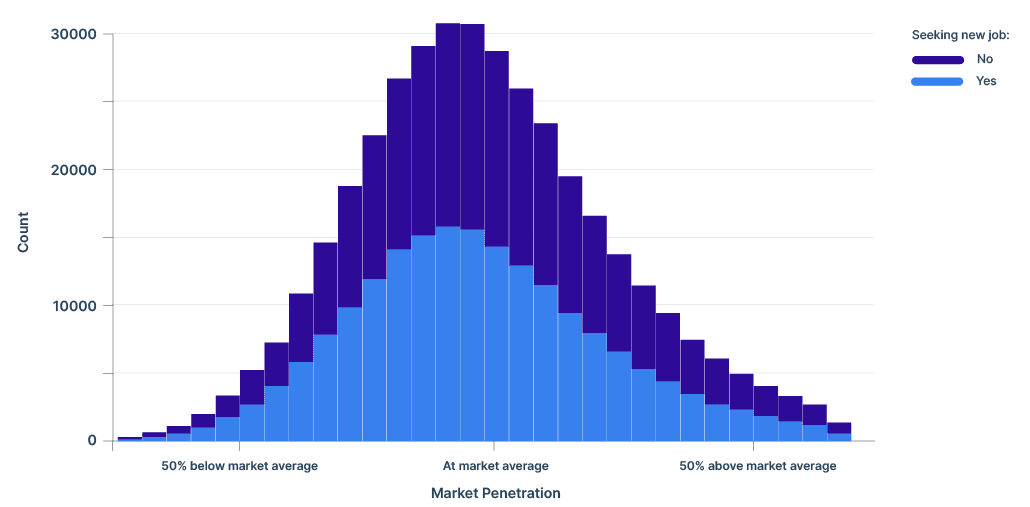

This means that employers have a lot of work to do to strengthen — or even just start — pay communications. And it definitely matters that employers do this. In addition to looking at perceptions of fair pay, Payscale also measured the impact on retention. Analysis showed no correlation between overall market penetration and job seeking behavior. In other words, how employees are actually paid compared to the market does not have a statistically significant impact on job seeking behavior.

However, the perception that pay was unfair – or the belief that an employee is paid below market – was correlated with a 49.7 percent increase in job seeking behavior. Simply put, this means that belief that pay is fair matters more for retention than where an employee actually falls along a pay range.

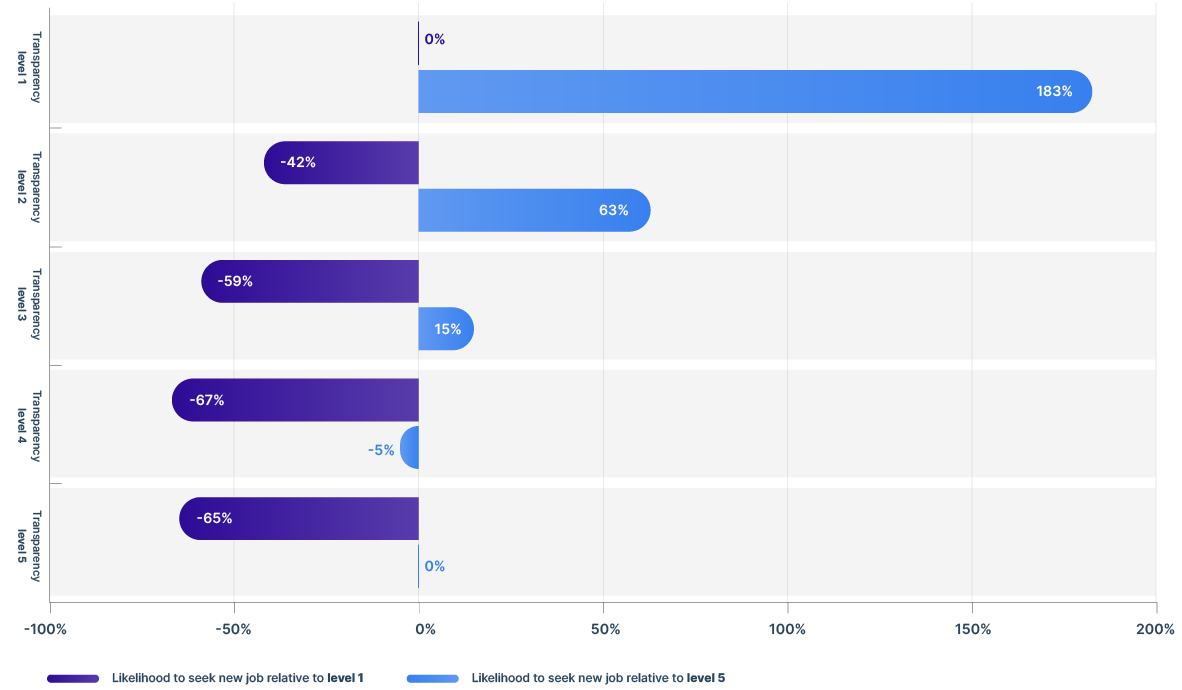

Fortunately, Payscale’s Fair Pay Impact Report also shows that pay transparency is strongly correlated with lower job seeking behavior among employees. In our research, employees were asked to rate their organization’s pay transparency on a scale of 1 to 5. Employees who felt that their organization was very opaque about their pay practices (1) were 183 percent more likely to look for another job than a five. That is almost three times more likely. Conversely, employees who felt their organization was very transparent (4 or 5) were 65 percent less likely to seek out new opportunities than employees who rated their organizations a one.

The unfortunate thing is that the majority of employers are not transparent about pay and don’t do very well at pay communications currently. Indeed, 78 percent of employees describe their organization’s transparency as a three or below.

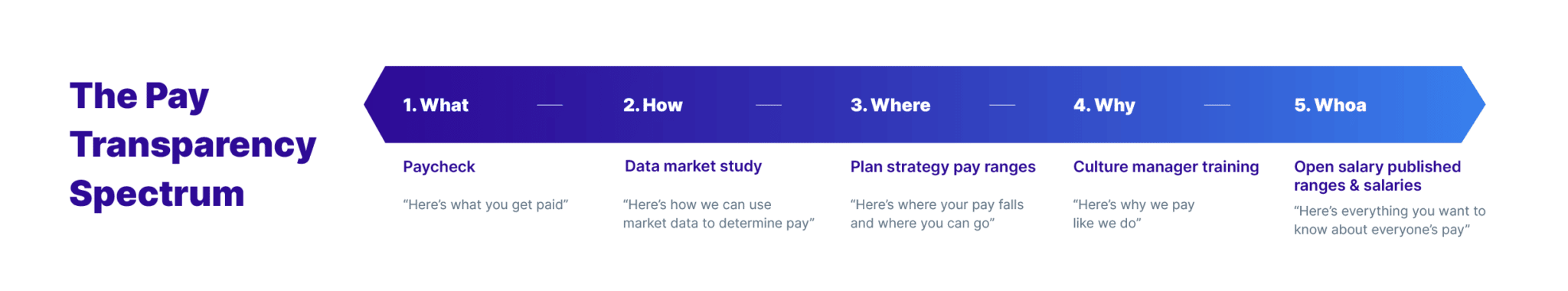

Pay communications aren’t easy for a majority of organizations for a variety of reasons. First, some HR leaders assume that pay transparency is all or nothing — either pay is secret or pay is public — when actually pay communications falls on a spectrum. In the middle of the spectrum, the employee’s pay and how it is determined is explained to the individual by their manager in more detail than what they see on their paycheck.

Any serious retention strategy should therefore start with pay communications. This is specifically critical for reducing turnover, not increasing engagement. The truth is that employees can love their job, their manager, their team, and their work culture – in other words, be highly engaged — and still seek other opportunities if they feel they are underpaid. Pay is intrinsically tied to personal valuation and accomplishment. When employees believe they are being paid less than other people for the same work, they feel compelled to correct the imbalance.

The bottom line is that a key component of retention strategy is communicating about the fairness of pay to employees, including explaining how you determine their pay (what data do you use? What compensable factors influence pay determinations?) and what the opportunities are to increase their earnings. Don’t assume that employees understand the value of your benefits either! It’s worth taking the time to explain how you arrived at what you provide as well as the equivalent dollar value for each benefit.

A total compensation statement like the following from Payfactors (now part of Payscale) can be useful in doing this:

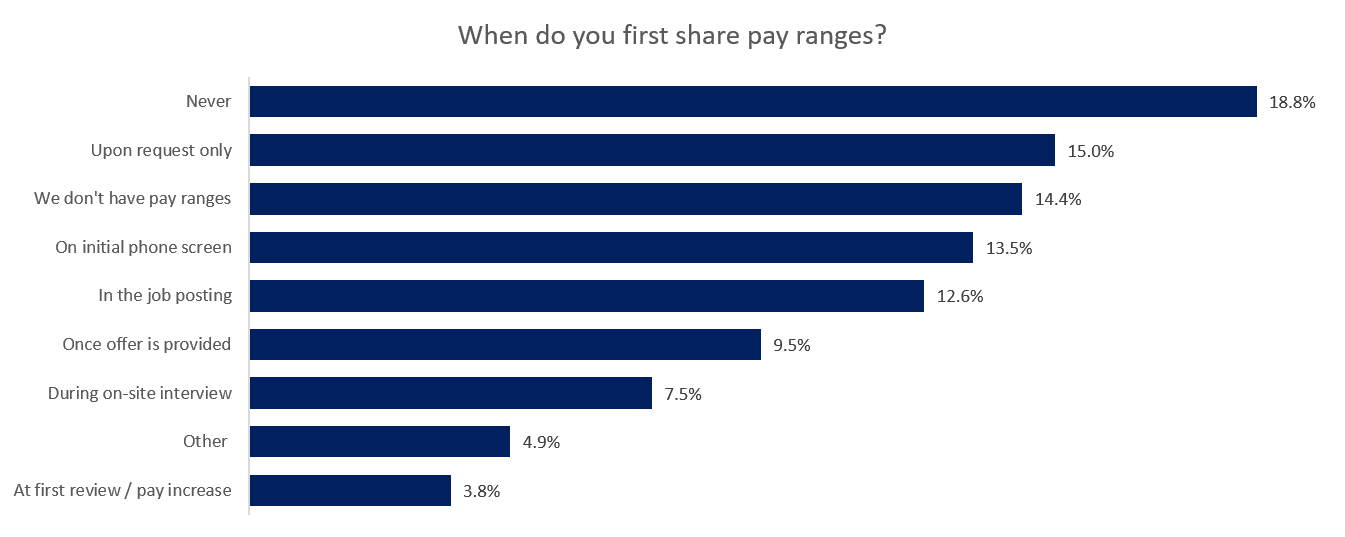

This simple exercise in pay communications goes a long way. However, the degree to which an organization can do this depends on how much they have invested in compensation data, strategy and structures, and manager training. According to Payscale 2021 Compensation Best Practices Report, 54.6 percent of orgs want to share pay ranges, but only 33.6 percent actually share pay ranges currently. A lack of investment in compensation strategy, formal structures, and communications training makes pay transparency and pay communications tricky if not impossible.

In our CBPR survey, we also asked when organizations “first” share their pay ranges. Unsurprisingly, a near majority never share pay ranges, don’t have pay ranges to share, or only share them upon request. For those that do share pay ranges, doing so in the initial phone screen is the most popular at 13.5 percent while 12.6 percent of organizations share pay ranges in the job posting, which has become more common only recently but can be a differentiator in getting applicants to apply to jobs.

Some organizations worry that “exposing” what they pay will put them at a disadvantage with competitors, but the reality is that employees can readily find out what competitors are paying. Salary information is out there. Transparency simply builds trust. The true advantage isn’t in keeping pay secret but in making sure your pay practices are grounded in data, readily defensible, equitable, and fair. When you put the effort into levelling up your compensation strategy, your pay practices become a differentiator that you should want to communicate, at least to the individual employees whose confidence in the organization will increase because of it.

Indeed, in previous research Payscale found that even when employers paid below market average, 82 percent of employees felt satisfied as long as their manager clearly communicated the reasons behind why their pay was lower. In addition, employees who are overpaid do not show higher job satisfaction than those paid at market, showing that a mature and well-communicated compensation strategy is more effective at retaining talent than simply offering already well-compensated employees more money.

The best part about pay communications is that it is a cost-free way to retain talent. 2021 is shaping up to be a difficult year for many organizations when it comes to salary budget planning for the pay increase cycle in 2022. According to Payscale’s Compensation Best Practices Report, COVID-19 resulted in nearly 20 percent fewer business giving pay increases in 2020 or 2021 than in previous years. In many cases, this was a deferment that will come due in 2022. In addition, there are minimum wage increases, higher inflation, and a war for talent that has become red hot, with many job openings going unfilled and turnover increasing.

Employers are going to have to invest more in compensation if they want to remain competitive, but they need to be strategic about it. Careful attention should be paid to occupations that have suffered from wage stagnation, especially essential services which may have gotten less attention before the pandemic. Of course, high performing professional talent and revenue earners are also important to retain. Employers should look to conduct a merit matrix to ascertain which employees with consistently strong performance reviews are perhaps not being paid competitively to their peers or to the market as these are potential flight risks. But make sure to communicate the changes! This is what will help to retain people who believe they are underpaid.

Customers of Payscale will have multiple resources for tackling these important problems. In addition to salary data and a suite of compensation management software solutions that come with a wealth of pay analysis tools, Payscale also offers professional services in compensation management best practices and pay communications training, managed services for advanced reporting, and opportunities for employers to network with other HR leaders and compensation professionals in their industries.

View the full Fair Pay Impact Report and download our whitepaper on How Fair Pay Perception and Pay Transparency Combat Turnover.

Looking to learn more about compensation management, and particularly how to excel beyond market pricing? For a crash course in best practices, hot topics, sage advice, case studies, and peer-connection opportunities, you are invited to attend Payscale’s virtual (and free!) annual event Compference 2021.